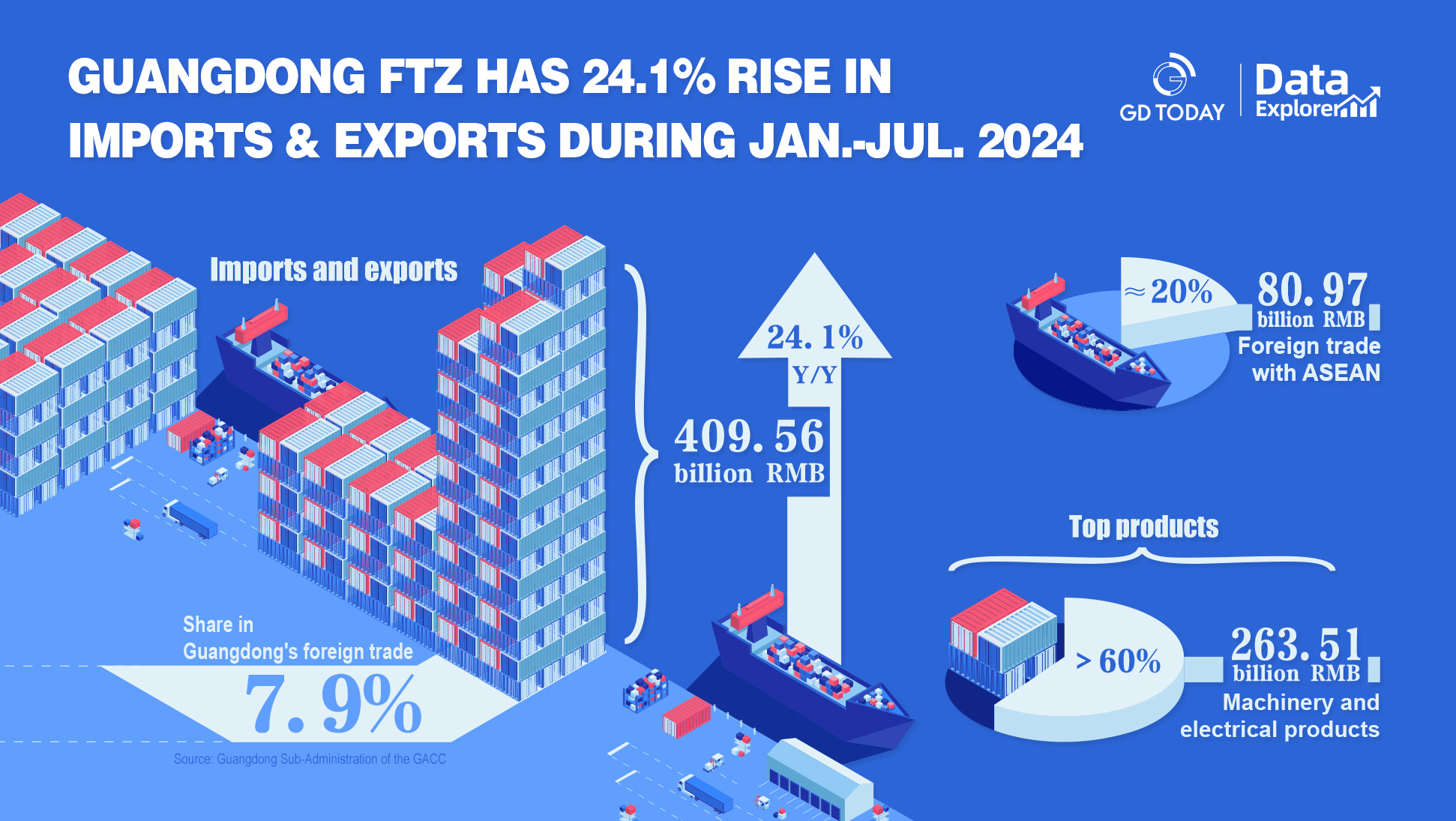

In the first seven months of this year, the total import and export value of the Guangdong Pilot Free Trade Zone reached 409.56 billion RMB, a year-on-year increase of 24.1%, according to the Guangdong Sub-Administration of the GACC. Additionally, its share in foreign trade imports and exports of the province has steadily increased to 7.9%.

Notably, machinery and electrical products accounted for 263.51 billion RMB, making up over 60% of the total. The trade with ASEAN reached 80.97 billion RMB, comprising nearly 20% of the overall imports and exports.

In June 2023, China’s State Council issued several measures aimed at aligning pilot free trade zones and ports with international high standards, which were implemented in five regions, including Guangdong.

Over the past year, customs authorities in Guangdong have actively worked to integrate international economic and trade rules, establishing a framework and regulatory model that facilitates higher levels of institutional openness.

Faster and More Transparent Customs Clearance

Nansha Port, the largest single port in South China, has rapidly improved its cargo clearance processes. At the terminal’s checkpoints, container trucks can now pass through in just 10 seconds – from photo capture to barrier lift. The standardization and transparency significantly enhance predictability for businesses during the import process, thus creating a more favorable environment for trade development.

The customs authority is also guiding companies to leverage policies to expedite the release of goods within 48 hours of arrival if all clearance information is provided.

For air freight, customs at Guangzhou Baiyun International Airport and Shenzhen Bao’an International Airport have adopted non-intrusive inspection, allowing most express air cargo to be cleared within six hours of arrival.

Lowered Customs Costs Foster Business Growth

The reduction in customs costs is crucial for improving cargo clearance efficiency and enhancing intelligent regulatory oversight, thereby continuously optimizing the port clearance environment.

Customs officials are precisely matching their services to meet the demands of businesses. Regarding the benefits of the origin policy, minor errors in certificates of origin are allowed. As long as the origin qualification of the goods is confirmed, small discrepancies such as printing mistakes, typographical errors, or non-critical omissions in information do not affect a company’s eligibility for preferential tariff treatment.

Meanwhile, customs have introduced smart reviews for certificates of origin, establishing the Shenzhen Service Center of RCEP (Regional Comprehensive Economic Partnership), which has upgraded the “smart review” platform to achieve instant approvals, with over 70% of certificates processed through intelligent systems.

Support for Enterprises to Maximize Policy Benefits

Customs is committed to helping businesses fully capitalize on available policies. They guide companies in processing temporary entry and exit formalities and promote diversified tax guarantees. For eligible key enterprises, they explore various guarantee methods, such as customs bonds and government-backed guarantees.

Shenzhen Mawan Power Co., Ltd., primarily imports thermal coal from Australia and Indonesia and has received tailored support from Shenzhen Customs. By establishing a one-on-one support mechanism, customs guided them in timely filing and facilitated tax guarantees through financial group backing and customs bond insurance, speeding up subsequent tax transfer processes and reducing capital occupation costs. The customs’ full support for the rapid clearance of coal imports has enhanced clearance efficiency by 40%.

In the next step, Guangdong‘s customs authorities will continue to advance strategies for enhancing the free trade zone and foster innovative customs practices, in order to support Guangdong‘s free trade zone in becoming a higher-level open platform.

Reporter | Hannah

Poster text | Hannah

Poster | Jocelyn Cai

Editor | Nan, Monica, James